Major crypto token prices remain under pressure

Effects of Celsius “pause” on withdrawals reverberate through the market

Growth risks of monetary policy tightening already showing in Europe

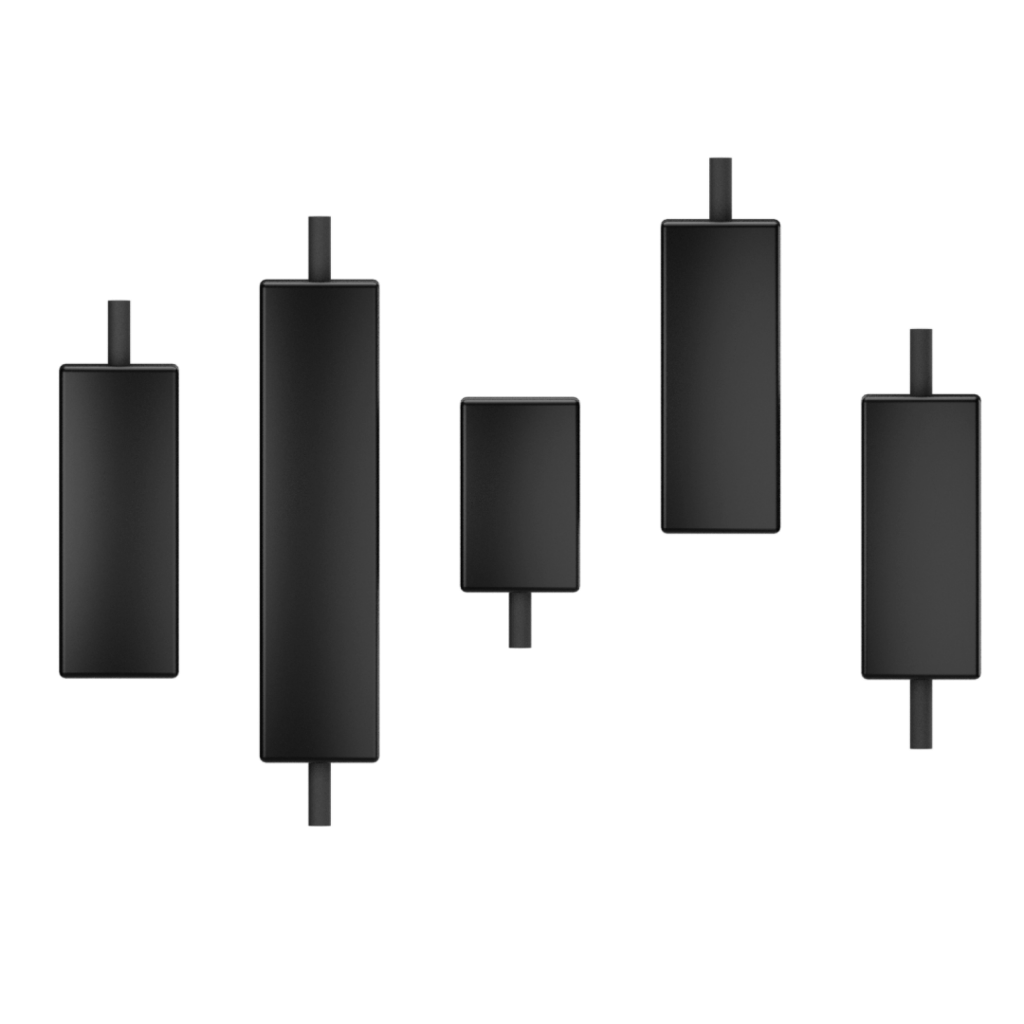

Major crypto token prices have moved marginally off their latest cycle lows but remain at depressed levels. The fact that bitcoin and ether have thus far managed to hold above psychological support areas of $20,000 and $1,000 respectively is cold comfort in the current environment, especially considering the extent of the selloff seen in just the past week.

No clarity yet on Celsius “pause”

Pressure from the global tightening in monetary policy has been compounded in the crypto space by last month’s collapse of the Terra/LUNA ecosystem and this week by the action of crypto lending firm Celsius to “pause” withdrawals by users of its platform.

It may be locking collateral in a manner that is contributing to selling pressure

The Celsius situation has yet to be resolved and importantly, it looks to be locking up customer collateral in a manner that could be having negative ripple effects on crypto token prices broadly. Crypto news agencies The Block and CoinDesk are reporting that a large crypto hedge fund may be having solvency issues.

In traditional finance, and now in crypto, those types of issues raise speculation about forced selling (selling the assets of a fund at any price in order to meet customer redemption demands) as well as counter party risk (is the entity on the other side of a transaction financially able to complete it). None of this is confirmed but it is a primary topic of discussion in crypto market today.

European Central Bank already facing problems before rate hikes begin

As markets await the outcome of the FOMC meeting later today, the European Central Bank held an emergency meeting today to discuss “fragmentation risks” in the Euro area. The meeting comes less than a week after its last scheduled policy meeting and follows the dramatic selloff in the sovereign debt of Italy relative to that in “core” Euro area countries such as Germany.

The negative ripple effects of a distressed Italy…

In short, high debt countries such as Italy have had bond yields kept artificially low by large scale ECB bond purchases in recent years. With the ECB now ending those purchases, Italian yields have risen to levels that, if sustained, will put excessive downward pressure on the local economy.

This is a real—but not entirely unexpected—dilemma for European policy makers.

…could drag European growth lower

For crypto investors, there are several takeaways. First, slower European growth will have negative implications for global growth in a manner that will create a less robust climate for investment and financial assets generally, and crypto assets could feel some of those pressures.

Europe’s troubles highlight the growth risks as many countries tighten policy

Second, and related to the first, the global tightening in monetary policy holds downside risks to economic growth on a global scale. That issue has become more prominent in the US where the even more aggressive tightening path the markets now expect from the Federal Reserve have raised the risk that the Fed’s actions will push the economy into recession. And again, a weaker US/global economy implies lower investment returns, an environment that would create headwinds for crypto.

A lot more risk has now been priced in

Importantly, those economic growth/investment return concerns are part of what has been driving financial assets lower since late last year and, in particular, in recent weeks. Hence, some of those risks are now being reflected in the lower prices of equities, bonds and crypto tokens. Less clear is how much of those economic risks will be realized, and how much further markets need to adjust to reflect those risks.

Original source: www.einpresswire.com/sources/u466736

Disclaimer:

Digital Asset Morning Call is for informational purposes only and does not constitute, either explicitly or implicitly, any provision of services or products by ALT 5 Sigma (“ALT 5”). Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. ALT 5 Sigma. makes no representation or warranty to any investor regarding the legality of any investment, the income or tax consequences, or the suitability of an investment for such investor. ALT 5 Sigma does not solicit or provide any financial advice. This is at the sole discretion of the individual.