Since their inception, digital assets have been met with controversy. Indeed, investors – both institutional and retail – have paused on adopting Bitcoin and other digital assets due to a range of uncertainties, ranging from the volatility of Bitcoin to the fact that verifying cryptocurrency transactions consumes a lot of energy. However, in the wake of the global pandemic, this trend appears to be changing quickly.

The financial services sector has accelerated its integration of integrate new technologies and networks – from decentralized finance to new payment systems, bringing new benefits to investors and consumers. As more people realize the benefits of decentralization – greater convenience, speed, and transparency – digital currencies are now emerging as a viable form of currency.

In the past few months alone, institutions such as Visa and Mastercard have integrated crypto currencies into their businesses, allowing consumers to use their credit cards to buy crypto assets or exchange these assets to traditional currencies for spending. The reason: consumer demand; MasterCard, for examples, surveyed its North American customers and found that more than 93% of them intend to use cryptocurrencies or other emerging payment options to pay for goods and services in the next year.

AXA lets its European customers pay their insurance premiums in Bitcoin. JPMorgan, Morgan Stanley, Fidelity, and others let clients buy digital assets or will do so soon.

These companies, as well as banks and institutions will continue to invest in cryptocurrencies as consumers and businesses recognize that decentralization provided by blockchain crypto transactions presents a more secure way for a peer-to-peer direct transaction at lower cost by eliminating the third banked party and exchanging money directly. Another significant development has been El Salvador's recent decision to make bitcoin legal tender.

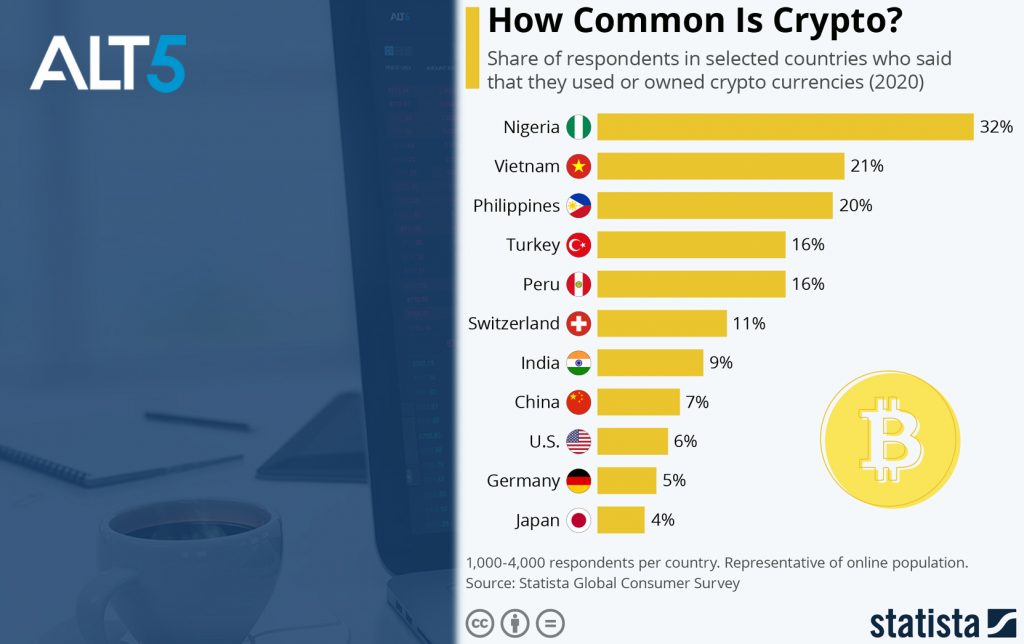

Many consumers in developing countries – Nigeria is the leading country in Bitcoin adoption – do not have bank accounts. Access to Bitcoin and other cryptocurrencies is helping to popularize cryptocurrencies by democratizing financial services for more people than ever before.

And the benefits aren’t limited solely to consumers. Digital currencies provide opportunities for businesses all over the world to increase efficiencies by engaging in transactions in which they do not incur fees from currency exchange and other third parties. Companies such as Microsoft, PayPal, Home Depot, and Starbucks already accept Bitcoin as payment.

The numbers tell quite a story: As of June, there were 221 million cryptocurrency users – more than doubling the number of users – 106 million – in January, according to Crypto.com. Statista’s research shows that much of the growth is occurring in Southeast Asia and Africa, including Nigeria, Vietnam, and the Philippines, followed by countries in Latin America such as Peru.

With more consumers using digital currencies, the safe bet is that institutions and businesses will quickly follow suit.