Constructive price action sidesteps macro stresses

Bitcoin correlation with risk assets emphasized

Another high-profile hedge fund considers crypto

Bitcoin (BTC) price action has turned more constructive as the rally in recent days has seen it touch $44,000 and threaten to break above the February-March highs of $45,426-$45,855, a development that would add to bullish sentiment. The gains are also being accompanied by—and perhaps encouraging—appreciation in other crypto assets. For example, Ethereum (ETH) moved back above $3,000 while Solana (SOL) broke above $100, to name a few.

Macro backdrop is not improving

Importantly, the recent gains have taken place against a macro backdrop that remains challenging and unsettled by the combination the ongoing war in Ukraine monetary policy tightening by global central banks. Those factors partly explain why, despite recent gains, bitcoin and most other major tokens remain well below their cycle high.

The Fed goes from hawkish to more hawkish

This past week, the Federal Reserve enhanced the hawkish guidance it gave following the March 16 FOMC meeting, with several officials highlighting the potential for even larger rates hikes (50 bp rather than 25 bp) at upcoming FOMC meetings.

The comments, starting just days after the last Fed meeting concluded, come alongside increasing concern that inflation won’t begin to move demonstrably towards the Fed’s 2% target soon enough. They may also reflect some relief among policy makers that the “official” hawkish messaging at FOMC meeting did not rattle financial markets (other than bonds), allowing the Fed to opportunistically step up its rhetoric further without sparking broader risk off move (at least not yet).

Inflation matters to bitcoin over time…

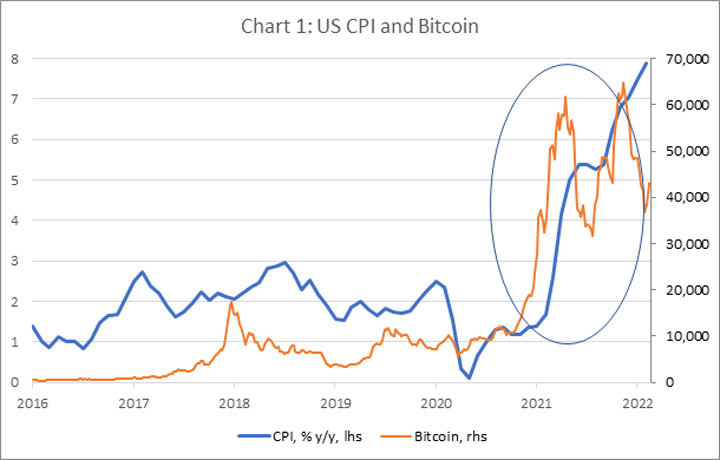

Bitcoin’s decline since last November in the face of accelerating US inflation has understandably raised questions about its utility as an inflation hedge. However, bitcoin’s considerable price gains in the past 1-1/2 years have indeed occurred alongside the surge in US CPI (Chart 1), giving some credence to the inflation hedge arguments.

…but correlation with risk assets is higher at present

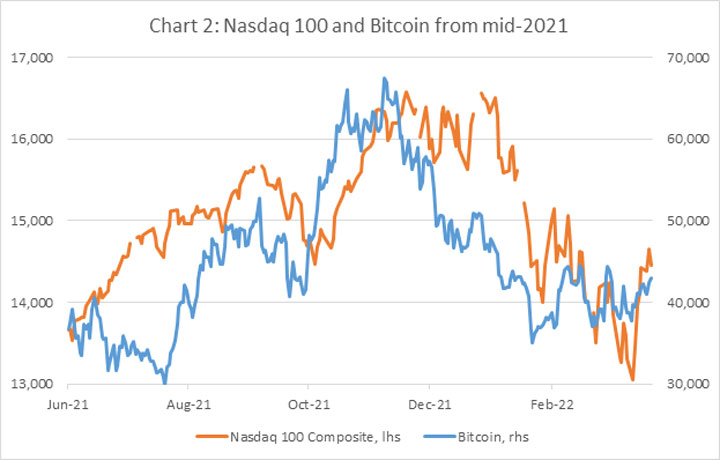

More recently and more relevant at present, a stronger correlation has been seen between bitcoin and risk assets (Chart 2). That is not unusual as bitcoin has often shown a strong correlation with risk assets over the long term. Just as relevant is that risk assets themselves have recently held up in the face of Fed tightening, higher market interest rates, increased concerns of recession and the war in Ukraine.

The week ahead:

For now we view the macro backdrop, rather than crypto-specific developments, as posing the more obvious downside risk to crypto and risk assets more broadly. In that respect, scheduled data and events in the coming week are limited, but a standout will be the US monthly employment report on April 1 which is always an important event for financial markets. And of course, developments in Ukraine will be very much on the market’s radar.

On institutional adoption of crypto

One news item that absolutely drew attention this week was a CoinDesk report that Bridgewater Associates, the giant hedge fund firm run by Ray Dalio, may be starting to invest in crypto. The increasing appeal and adoption of crypto by institutional investors is a critical theme in the crypto universe. High profile names such as Paul Tudor Jones, Tesla and MicroStrategy made big news with their crypto investments in the past year-plus. More broadly, a Fidelity survey of institutional investors from September 2021 showed that 52% of respondents were already invested in digital assets.

So in some respects, the question may not be whether institutions will allocate to crypto, but rather the size and pace of those allocations. Nonetheless, when a firm with the size and notoriety Bridgewater says it is considering (or perhaps already has?) crypto investments, it not only makes a short-term splash among market participants and gives bitcoin a shot in the arm, it also reinforces the larger and longer term trend of institutional adoption of the asset class.