Bitcoin and Ethereum consolidation near recent highs keeps bias positive

US yield curve inversion comes with caveats

Looking for news on the Fed’s balance sheet plans

China and Eurozone developments highlight strains on global growth

The price action in Bitcoin and Ethereum continues to be an important and thus far constructive factor in the near-term outlook for both assets. Although recent upward momentum has stalled, both currencies have consolidated most of their recent, sizeable gains from mid-March, rather than measurably retracing them. Those gains, trough to peak, measure 29% for Bitcoin and 42% for Ethereum.

All that said, additional near-term gains could prove more difficult with potentially formidable resistance defined by the 200-day moving average for both currencies; currently $48,320 in Bitcoin and $3,490 in Ethereum as of April 1.

Trouble with the curve

The US yield curve has traditionally been viewed as an indicator of future economic developments. Thus, when the US Treasury 2yr yield briefly rose above the 10yr yield this week, “inverting” the curve, market participants understandably began to more seriously consider the risk for an economic recession in the not-too-distant future.

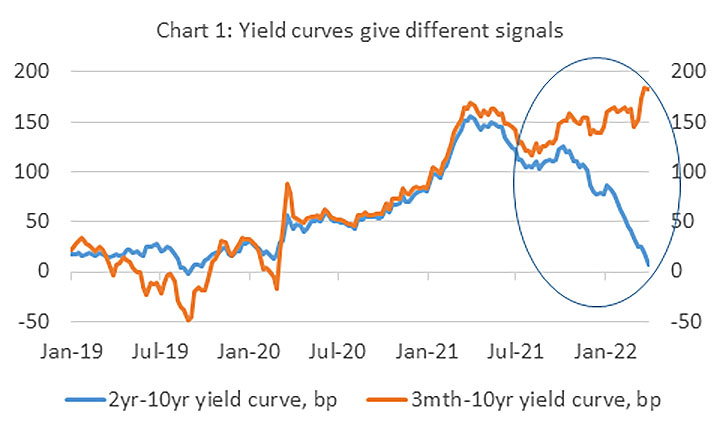

Without over analyzing yield curve developments, there are a few factors to consider before jumping to the conclusion that a recession is definitely in the offing. First, ongoing Fed purchases of Treasury securities are holding down longer term yields, like the 10yr note. And that may be distorting the signal coming from the 2yr-10yr yield curve. Second, some economists prefer the curve measuring 3-month Treasury bill yields against the 10yr Treasury yield as a recession indicator. That curve currently trades near 180 bp and has actually steepened by 30 bp since early March (see Chart 1).

For crypto investors, the key issue revolves around the outlook for economic growth. If in fact the US economy goes into recession, weaker growth will present headwinds to financial assets generally, including crypto. But the current 2yr-10yr curve inversion may be a less reliable indicator of recession than it has historically. All that said, this is likely to remain very topical in financial markets, and requires that crypto investor continue to monitor macro backdrop and outlook closely.

US labor market a clear bright spot in the economy

The US March labor market report showed payrolls 431K, near expected when factoring in upward revision to prior months. The unemployment rate fell to a new pandemic low of 3.6% from 3.8% in February and the participation rate ticked up one-tenth to 62.4%, indicating people are gradually being drawn back into the workforce. Hourly earnings rose 5.6% y/y, near expected but maintaining the solid levels of wage growth evident since last spring.

The data describes continued strength in the labor market, a definite bright spot in the economy. Other things equal, it will keep upward pressure on yields and reinforce expectations for a larger 50 bp rate hike by the Fed at their next meeting on May 3-4.

Next week brings FOMC meeting minutes

The minutes from the Federal Reserve’s March 15-16 policy meeting are due in the coming week. With Fed officials already suggesting the potential for a more aggressive rate hike path, the bigger focus is likely to be on its plans for the pace of balance sheet reduction.

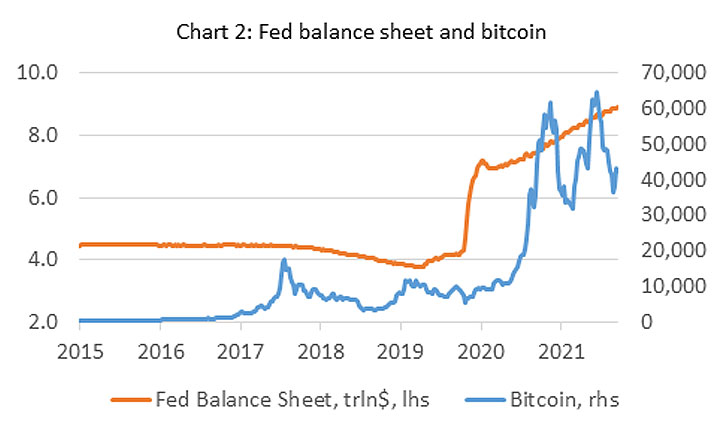

Fed’s balance sheet: what goes up must come down…but when and how quickly We view the Fed’s dramatic liquidity injections into the financial system during the pandemic as an important contributor to the appreciation in crypto assets (and risk assets more broadly). Accordingly, the withdrawal of that liquidity via simultaneous rate hikes and balance sheet reduction has the clear potential to be challenging to crypto assets. Some of those risks are already reflected in the pullback of bitcoin from its $69,000 peak in November. But that does not preclude the potential for further headwinds. Hence, to the extent that the minutes provide guidance on the potential pace of balance reduction, it will be monitored by crypto markets.

Global conditions weaken

Developments in Asia and Europe this week highlight the risks to global growth. China’s Purchasing Managers Index (PMI) fell below the 50% expansion/contraction level in March, a development consistent with slowing growth going forward and representing a headwind to crypto prices. The decline in China’s PMI comes alongside additional, widescale lockdown associated with the covid pandemic. Authorities have indicated they will ease policy if conditions warrant. Market participants should be on the lookout for such actions as they could offer crypto prices some support if they are announced.

Despite some reports of progress in the Russia-Ukraine cease fire negotiations, the reality is that the war persists and the economic fallout continues to accumulate. This week, reports indicated that Germany is considering gas rationing to deal with reduced supplies from Russia. Energy rationing would hit economic activity (reduced ability to run factories, travel, etc.) and risk to future German/Eurozone growth.

And as in the US, inflation in Europe is also rising to even more problematic levels. Eurozone CPI rose 7.5% y/y in March, well above expectations and another record high. Higher inflation not only represents a tax on growth, it also increases the chances for earlier ECB policy tightening. The combination of downside risks to growth and surging inflation will fuel concerns about a stagflation backdrop. Similar to the implications from China slowing, a weakening Eurozone economy poses global growth risks that can prove challenging to crypto assets from a macro perspective.