Another round of high inflation prints keeps market focus on future Fed tightening

Fed tightening impacts the economy and markets through financial conditions

Bitcoin sensitivity to financial conditions is an important dynamic

Bitcoin and Ether have already adjusted to a good portion of economic and industry risks

For all of the market’s justifiable concerns about rampant inflation and downgraded growth expectations, the price action in major crypto tokens has been relatively stable in recent weeks. Of course, that stability needs to be viewed alongside the steep price decline that bitcoin and ether have endured this year, and particularly in the past several months. Still, we continue to view those declines as factoring in some good portion of the macro risks that are now prominent.

Higher inflation prints are not new, but also not helpful

Inflation and growth are the two primary macro features that continue to dampen the economic outlook, creating headwinds for crypto prices and financial assets broadly. This past week, higher US CPI and PPI data dampened hopes that inflation had peaked and would soon start to decelerate. That encouraged renewed gains in short-term US yields, which once again factored in a more aggressive path of Fed tightening.

Some relief that inflation expectations eased

Another important piece of inflation data was released Friday, and was somewhat less worrisome. The University of Michigan survey showed inflation expectations fell in July. The medium- term (5yr-10yr) measure fell to 2.8% from 3.1%, and the 1yr measure slipped to 5.2% from 5.3%.

The Fed is especially concerned about inflation expectations, as higher levels could see that outlook become embedded in consumer views, and potentially contribute to a self-perpetuating kind of inflation spiral. Hence, the downtick on the July inflation expectations—probably due in part to lower gasoline prices—will be a welcome development for Fed officials, especially after the unexpectedly high CPI/PPI prints earlier in the week.

More Fed tightening is coming

The upshot for crypto and financial markets is that the Federal Reserve now seems more likely to raise rates “only” 0.75% at its July 27 meeting, rather than an even more aggressive 1.0% which the CPI/PPI data may have argued for. The debate about the July FOMC meeting and the Fed’s path thereafter is hardly settled yet and will continue to be debated and priced to varying degrees in financial markets in the coming weeks and months.

The Fed views its policy impact through the lens of financial conditions

Importantly, Fed policy changes are designed to impact financial conditions. Financial conditions are comprised of short-term and long-term interest rates, corporate credit spreads, stock market valuations, and exchange rates. Tightening monetary policy via a higher Federal Funds rate has the impact of raising market interest rates, widening credit spreads, lowering stock market valuations and boosting the dollar. In short, it weakens the overall investment climate for most financial assets, including crypto assets.

Bitcoin shows sensitivity to swings in financial conditions

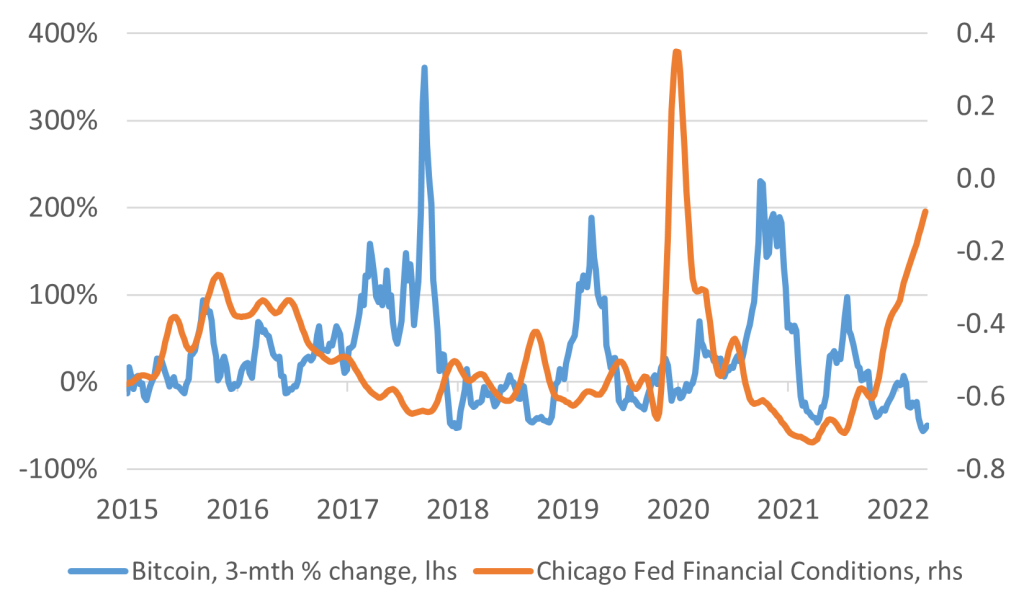

That is exactly what has been happening since the Fed “pivot” last November, when it began signaling that the period of easier monetary policy would begin to reverse. The accompanying chart shows a measure of financial conditions (produced by the Federal Reserve Bank of Chicago) and the percentage change in the price of bitcoin, measured over rolling 3-month horizons.

The chart shows that the tightening in financial conditions starting late last year did indeed concur with the decline in bitcoin. Moreover, it shows the tendency for bitcoin to perform well during periods of loose or loosening financial conditions, and for the token to underperform during periods of tight or tightening financial conditions.

In bitcoin’s relatively short history, financial conditions have only been tighter one other time

This will be a critical indicator to monitor going forward. In bitcoin’s relatively short price history (our chart goes back to 2015), there was only one period where financial conditions are tighter than they are now. That was in early 2020 at the start of the pandemic, when the dramatic decline equity and corporate bond prices tightened financial conditions significantly, and contributed to the sharp contraction in economic growth.

The Federal Reserve does not want to repeat that experience which is why it has not moved even more aggressively to tighten monetary policy. In essence, it is trying to achieve a “soft landing” for the economy, and it remains to be seen if that will be achieved. To do that, the Fed wants to keep financial conditions tight, but may not want to induce a dramatic tightening in conditions from here, say to the levels reached in 2020, given the economic harm that imposed.

Crypto and financial assets have factored in some good portion of the economic and industry risks

The takeaway from this is that the market adjustment to high inflation, to downside risks to economic growth, and to central bank tightening is already well advanced. That is evident in the rise in market interest rates, the lower valuations in equity markets, and the measurable decline in major crypto token prices.

That does not mean the bottom is necessarily in place for bitcoin and ether. A soft landing for the economy is hardly assured, meaning more economic headwinds could develop. Moreover, the tumult in the crypto industry specifically may not have fully played out yet.

Lower valuations and industry shakeout improve medium-term outlook for digital assets

But stepping back and taking a medium-term view, the combination of all of these factors continues to suggest to us that the bulk of the adjustment lower in major crypto token prices had already been seen. If so, it also suggests that the industry shakeout and improved token and company valuations are creating a better investment climate for the digital asset space over the medium-term.

Disclaimer:

Digital Assets Weekly Market Update is for informational purposes only and does not constitute, either explicitly or implicitly, any provision of services or products by ALT 5 Sigma (“ALT 5”). Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. ALT 5 Sigma. makes no representation or warranty to any investor regarding the legality of any investment, the income or tax consequences, or the suitability of an investment for such investor. ALT 5 Sigma does not solicit or provide any financial advice. This is at the sole discretion of the individual.