Crypto implications of this week’s central bank actions

RBA is the first in a series of central bank rate hikes expected this week

Crypto assets need to consider short term volatility and medium-term liquidity impact

U.S. SEC boosts its crypto investigations staff

The Reserve Bank of Australia, the country’s central bank, raised rates 25bp overnight, bringing its policy rate to 0.35% and also provided guidance that more interest rate hikes are likely to follow. Although the size of the hike was a bit larger than expected, the timing, direction and guidance are less shocking, particularly as markets already have another 200bp of tightening priced in by the end of this year.

Crypto assets and central bank actions

The RBA move has several notable implications for crypto assets. First, the RBA move sets the table for what is expected to be a series of rate hikes from central banks this week; the US, Brazil, Norway, the UK, Czech Republic, Chile and Poland all hold policy meetings this week and most—save perhaps for Norway—are expected to raise rates. As such, financial assets, including crypto assets, need to prepare for the short-term volatility that these actions could impose on financial markets. Second, if other central banks tighten policy as expected, it will mark a significant move to begin to more forcefully withdraw the massive, global, liquidity injections that monetary authorities took to address the economic fallout of the covid pandemic. To the extent that the heightened levels of liquidity boosted the prices of financial assets—including crypto assets—the withdrawal of that liquidity can be expected to weigh on those prices.

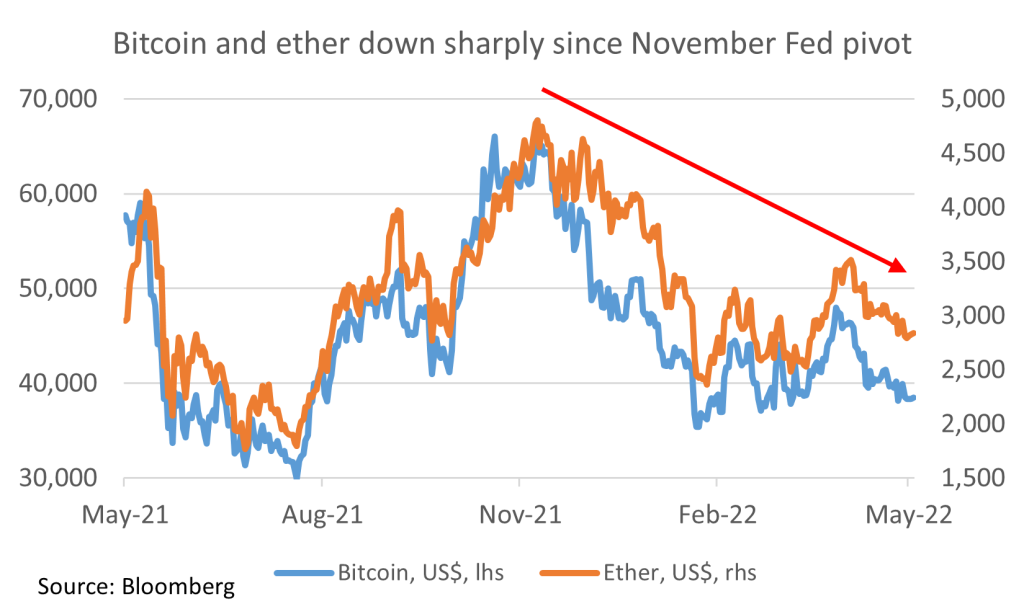

That has already started, given the obvious drawdown in prices since the Federal Reserve “pivot” in November when it began signaling a reversal in policy. That includes declines of 44% in Bitcoin (BTC) and 42% in Ether (ETH) from their November peak to present, and steeper 52% and 55% declines respectively when measured to their recent cycle lows reached in this past January (see Chart).

More headwinds seem likely from central bank normalization

Although there is already a good deal of central bank tightening priced into interest rate markets, there continues to be uncertainty over whether and how the tightening path could change, as well as the effects of upcoming balance sheet reduction by the Federal Reserve and others, a process that will also remove substantial amounts of liquidity from the economy and financial markets. In short, it seems more likely that the process of central bank “normalization” will continue to create headwinds for crypto assets and other markets that have benefitted from covid-inspired central bank liquidity.

On the regulatory front

The US Securities and Exchange Commission plans to hire 20 more investigators and litigators to its Crypto Assets and Cyber Unit, according to an article in the Wall Street Journal. A spokesperson for the SEC said, “the expanded unit will be at the forefront protecting investors and ensuring fair and orderly markets”. The digital assets industry awaits more clarity on the US regulatory framework from several US oversight agencies following President Biden’s executive statement on the space back in March, a process that is clearly complex and time consuming. In the meantime, the SEC is stepping up its more traditional investigatory charge in order to address the increasing number of firms and assets in the space.

Original source: www.einpresswire.com/sources/u466736

Disclaimer:

Digital Asset Morning Call is for informational purposes only and does not constitute, either explicitly or implicitly, any provision of services or products by ALT 5 Sigma (“ALT 5”). Investors should determine for themselves whether a particular service or product is suitable for their investment needs or should seek such professional advice for their particular situation. ALT 5 Sigma. makes no representation or warranty to any investor regarding the legality of any investment, the income or tax consequences, or the suitability of an investment for such investor. ALT 5 Sigma does not solicit or provide any financial advice. This is at the sole discretion of the individual.